聚焦誠信透明淨零轉型 2023台灣永續投資論壇登場

表揚綠色金融領航者 第三屆台灣永續投資獎頒獎

2023 TWSIA第三屆台灣永續投資論壇開幕式暨台灣永續投資獎頒獎典禮計有5位董事長、13位總經理、4位資深副總經理,以及12位副總經理出席盛會。

2023 TWSIA第三屆台灣永續投資論壇開幕式暨台灣永續投資獎頒獎典禮計有5位董事長、13位總經理、4位資深副總經理,以及12位副總經理出席盛會。

持續推動我國永續投資環境,台灣永續能源研究基金會(TAISE)長期與國內外產官學機構共同打造交流平台。除了辦理「2023第三屆台灣永續投資獎」,獎勵運用專業發揮「機構影響力」與「個案影響力」的金融機構,同時舉辦「TWSIF台灣永續投資論壇」,期待透過實體與線上互動,促進永續金融轉型。第三屆台灣永續投資獎區分「機構影響力」與「個案影響力」兩大項,其中在「機構影響力」方面,國泰金控與旗下各子企業分別榮獲金控、壽險、銀行、證券與投信五組典範獎,領先各金融集團,成績最為耀眼;而在「個案影響力」也得到二金二銀,企業議合與ESG創新表現,備受評審讚賞。

至於公股行庫,則以第一金表現最佳,銀行、證券、投信子公司分別抱回各組機構影響力楷模獎、保險得到壽險組績優,證券致力永續主題投資,得到一面銀獎;合庫則獲得個案影響力一金一銀二銅、以及投信組績優獎勵。

TAISE董事長簡又新大使表示,統整各投資顧問與智庫的統計,當今全球永續基金資產管理規模已經達到2.74兆美元,其中單看ESG相關ETF資產規模,超過5,400億美元,且還在持續加速成長中。而台灣永續投資市場也同樣熱絡,無論永續基金或整體機構投資人永續投資總額都不斷攀升,在永續主題投資、影響力投資、股東行動、企業議合及ESG創新都有傑出表現。

他提到,這股永續投資熱潮,也反應在本屆投資獎參賽情形上。根據執行委員會統計,今年參獎件數較2022年成長43%,從參賽內容也顯示國內許多新ESG基金類型正蓬勃興起,ESG研究和產品供應數量及範圍都不斷擴張,且還將持續蓬勃發展。

論壇主席簡又新大使(前排右7)、王儷玲前主委(前排左6)、丁克華前主委(前排右6)與TWSIA機構影響力類受獎代表合影。

「機構影響力」召集人、前金管會主委王儷玲呼應,永續投資已經成為主流,預估2025年全球ESG資產將占全球總管理資產三分之一以上,無論台灣企業本身、現有金融法規和各金融機構提供的綠色金融服務、整體生態系平台運作等,都必須要更積極應對。

然而就在各企業積極擁抱「永續」之際,如何防堵「漂綠」,也成為各國投資人關注焦點。回應整體國際趨勢,今年永續投資論壇的主軸聚焦「誠信透明的淨零轉型」(Transition, Transparency, Integrity),邀集國內外產官學各界聚集探討最新永續投資趨勢、規範和實務作為。

日本永續投資論壇主席荒井勝提到,儘管這些年對於企業永續資訊透明揭露的規範愈來愈清晰,但包括ESG的定義不明,缺乏人權、賄賂、公平競爭等最低保護措施等關鍵要求都還需要更強化,避免誤導投資者。

西班牙永續投資論壇(Spain SIF)副執行長 Andrea González則認為,當各界已經逐漸認識永續和影響力投資之後,現在必須提高績效透明度,伴隨參與者和監督機構高度參與,擴大社會對永續金融的支持,並且「停止繼續紙上談兵,開始行動!」

國際觀點以外,論壇也邀請台新金控首席經濟學家李鎮宇博士、以及標普全球評級大中華區業務鍾尚民高級經理介紹「永續投資實務與趨勢」與「全球永續投資發展」,同時舉辦「台灣如何建構永續影響力投資新生態系」以及「全球永續投資發展與國際典範分享」主題座談會;還安排國立臺北大學商學院、TAISE分別發表台灣永續投資調查、以及國際金融ESG專案研究成果。

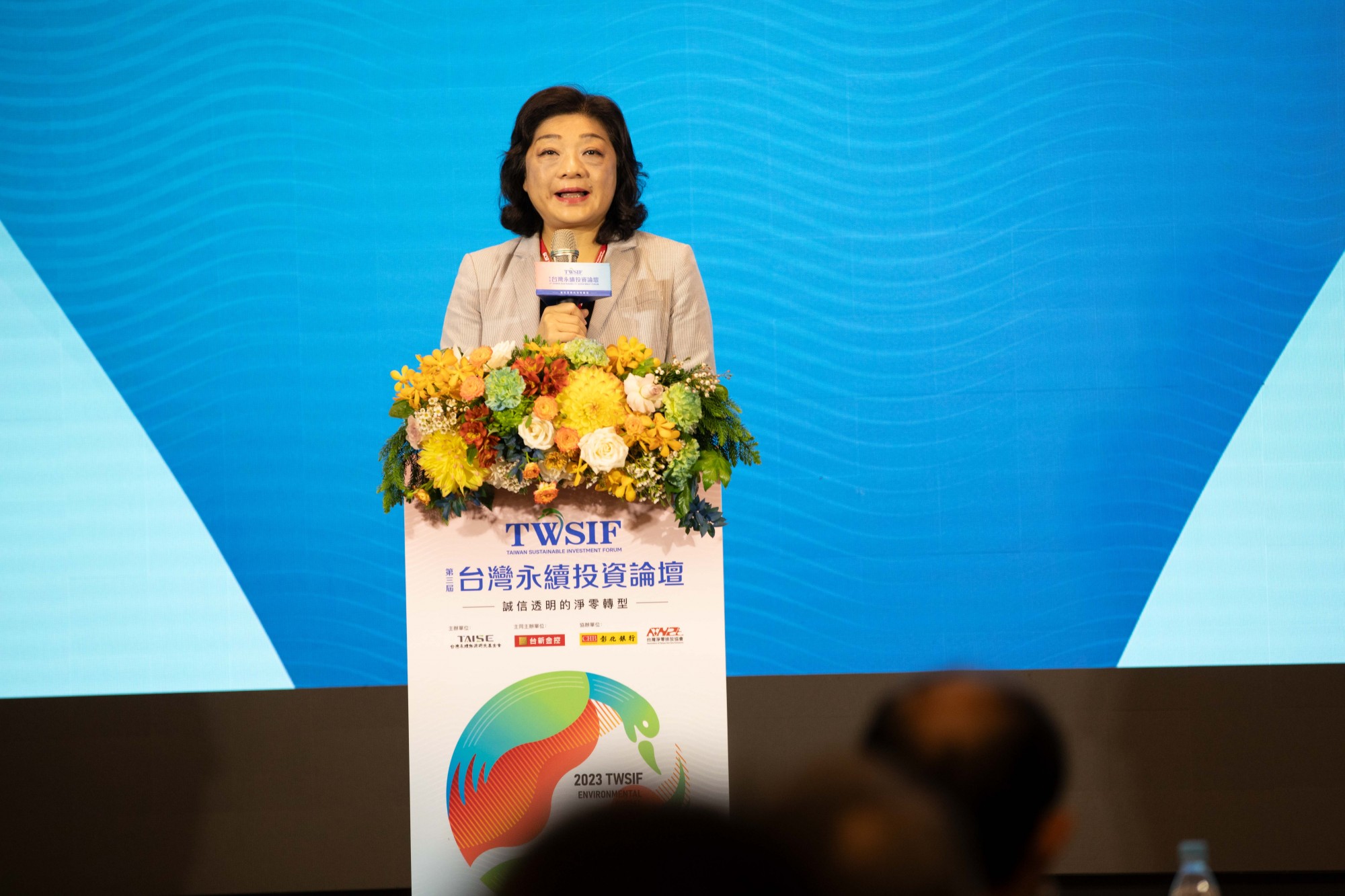

論壇主席簡又新大使肯定企業對於永續投資面向有傑出表現

王儷玲前主委感謝獲獎單位對於永續發展的投入與努力

丁克華前主委感謝獲獎單位企業對於永續發展的肯定與付出

The 3rd Taiwan Sustainable Investment Awards ceremony took place on June 30, and the awards were given to green finance pioneers.

The 2023 Taiwan Sustainable Investment Forum opening and the 3rd Taiwan Sustainable Investment Awards ceremony at the Courtyard by Marriott Taipei Downtown

For Taiwan working toward a sustainable investment environment, TAISE and some national and international organizations jointly created an interactive opportunity—they not only established the Taiwan Sustainable Investment Awards (TWSIA), but they also launched the Taiwan Sustainable Investment Forum in 2023. In the forum, speakers used both in-person and virtual approaches to interact with the audience promoting the transitions for financial sustainability.

The TWSIA has two different categories of awards: the institutional impact category and the impactful case study category. This year, notably Cathay Financial Holdings Co., Ltd. and its subsidiaries won five awards for their best performance in the management of financial services, life insurance, banking, financial securities, and investment trust in the institutional impact category. In the impactful case study category, Cathay Financial Holdings also performed well in corporate engagement and ESG innovation.

Chairman Eugene Chien encouraging the award winners to continue cultivating green finance

Chairman Eugene Chien encouraging the award winners to continue cultivating green finance

Eugene Chien, Chairman at TAISE, said that global sustainable funds' assets, including ESG exchange-traded funds (ETFs), hit $2.74 trillion at the end of March. ESG ETFs increased markedly and already reached $540 billion. He noted that this year TWSIA’s competition reflected this hot trend in global ESG investing when award submissions increased 43% from 2022. The trend indicates that research on ESG investing and ESG investment products will be constantly developed.

Wang Li-Ling, a former chairperson of the Financial Supervisory Commissions of Taiwan

Wang Li-Ling, a former chairperson of the Financial Supervisory Commissions of Taiwan, said that sustainable investment became the mainstream and ESG assets would reach a third of total global assets by 2025. Thus, the Taiwanese companies and financial institutions and financial regulations must be prepared to provide financial green services operated by an ecosystem platform. In addition to the issues of corporate sustainability, investors across the globe pay much more attention to how to prevent greenwashing. In 2023, net-zero transitions, transparency, and integrity were the forum theme. We invited experts from government, industry, and academia to discuss the most recent sustainable investing, its related regulation, and practice.

Masaru Arai, the chair of the Japan Sustainable Investment Forum, said that although the international frameworks for ESG data disclosure have developed at full or near capacity, the definitions of ESG factors are still vague. Particularly, protective measures for human rights, anti-corruption, and fair competition need to be further developed to provide investors with accurate information. Furthermore, Andrea Gonzalez, the director of Spain SIF asserted that in compliance with the regulatory institutions, we need to improve transparency on the performance of sustainable investing and gain society’s support to join us for sustainable investment. We must act now!

The forum also featured symposiums to discuss several important topics, including sustainable investing practices and trends and the global development of sustainable investment. Additionally, TAISE and the National Taipei University of Business presented survey results of sustainable investing in Taiwan and international ESG case studies.

Eugene Chien, Chairman of TAISE, Wang Li-Ling, a former chairperson of the Financial Supervisory Commissions of Taiwan, and the award winner in the impactful case study category